28+ Basis Calculation For Partnership

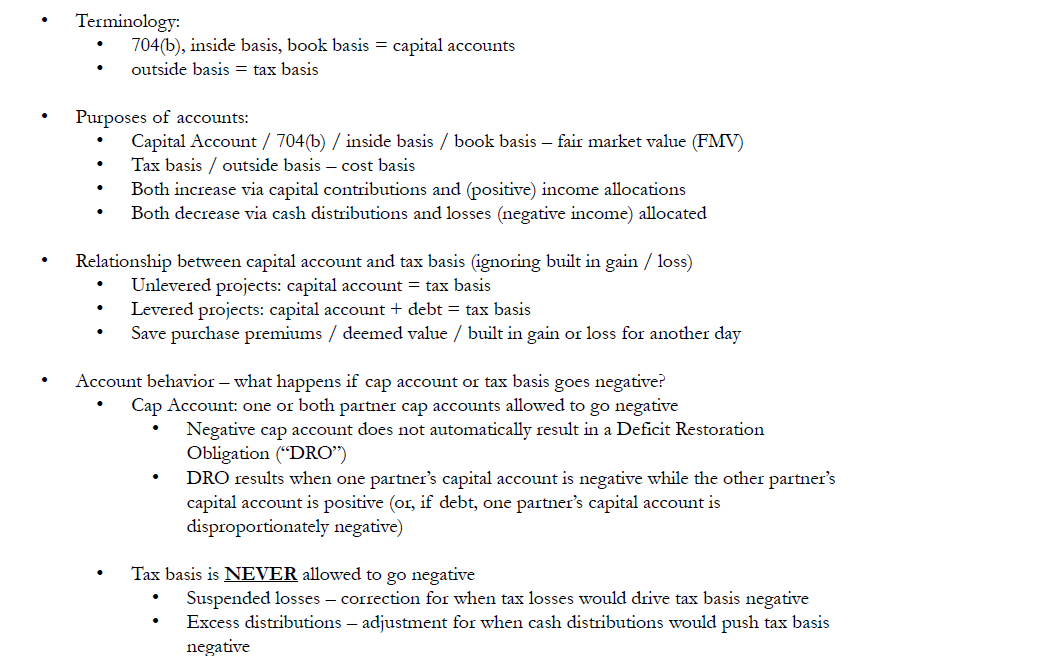

Web The partnership uses Schedule K-1 to report your share of the partnerships income deductions credits etc. The adjusted partnership basis.

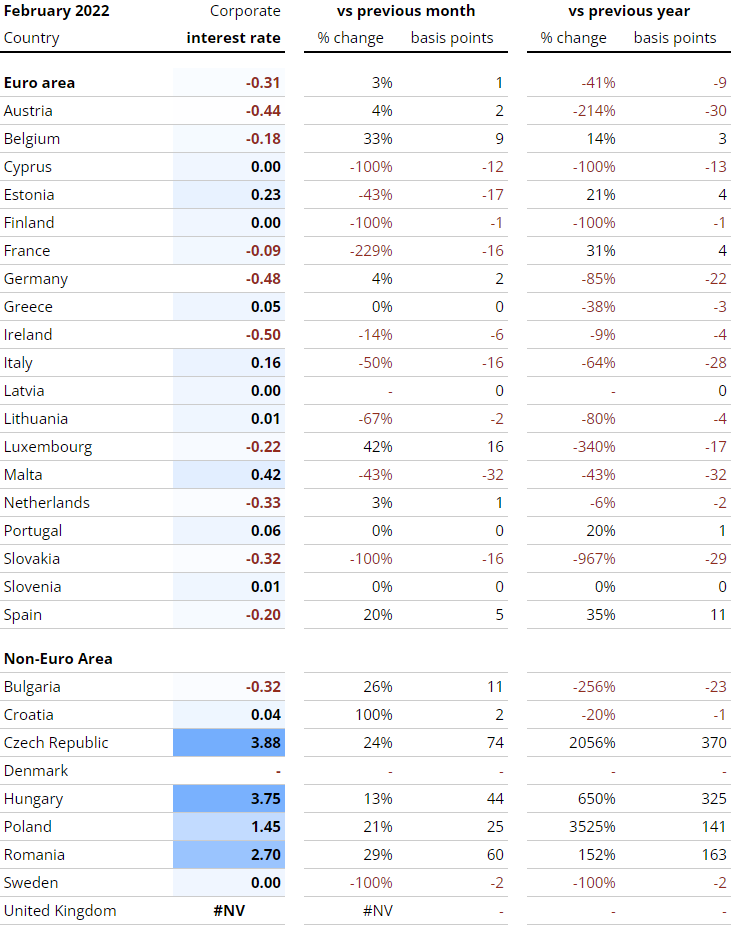

Interest Rates Explained By Raisin

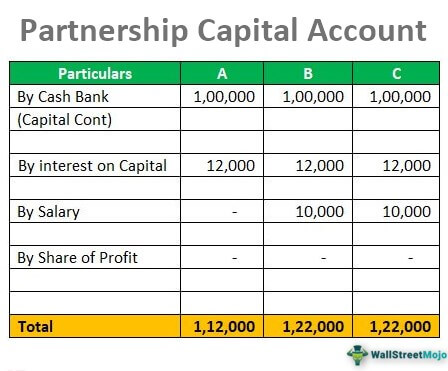

Web If the Bert and Ernie partnership has a net tax-basis income of 25000 add 12500 to each partners tax-basis capital account.

. The tax return capital accounts keep. Carryforward Worksheet Partners Outside Basis Calculation Interactive WORKSHEET W102. Web The calculation of basis consists of your financial contributions into the company plus ordinary income and losses minus distributions like dividends and other.

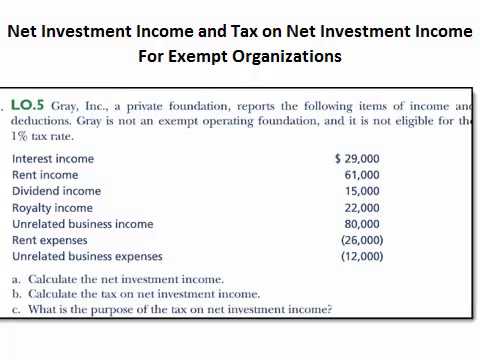

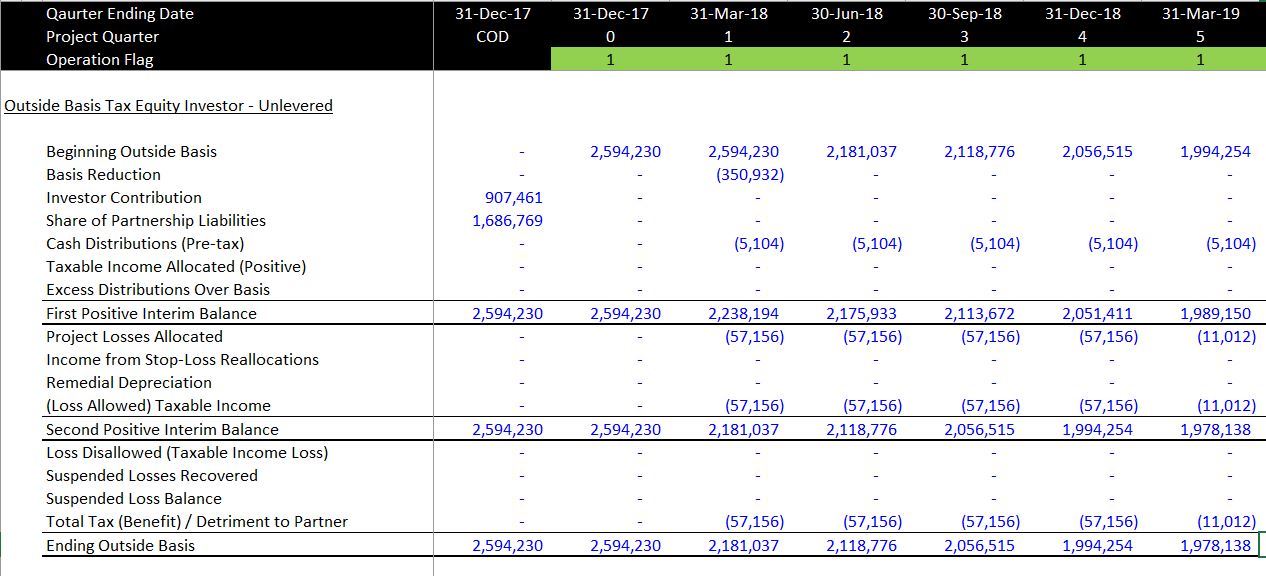

Web The basis calculation rules keep track of the partners basis ie his or her cost basis or after - tax investment in the partnership. Web On October 22 the IRS made its opening foray into the expanded 2020 tax basis capital reporting requirement that will apply to all partnerships. Web In this lesson we will explain how to calculate a partners basis in a partnership and a partnerships basis in assets contributed by a partner for federal income tax purposes.

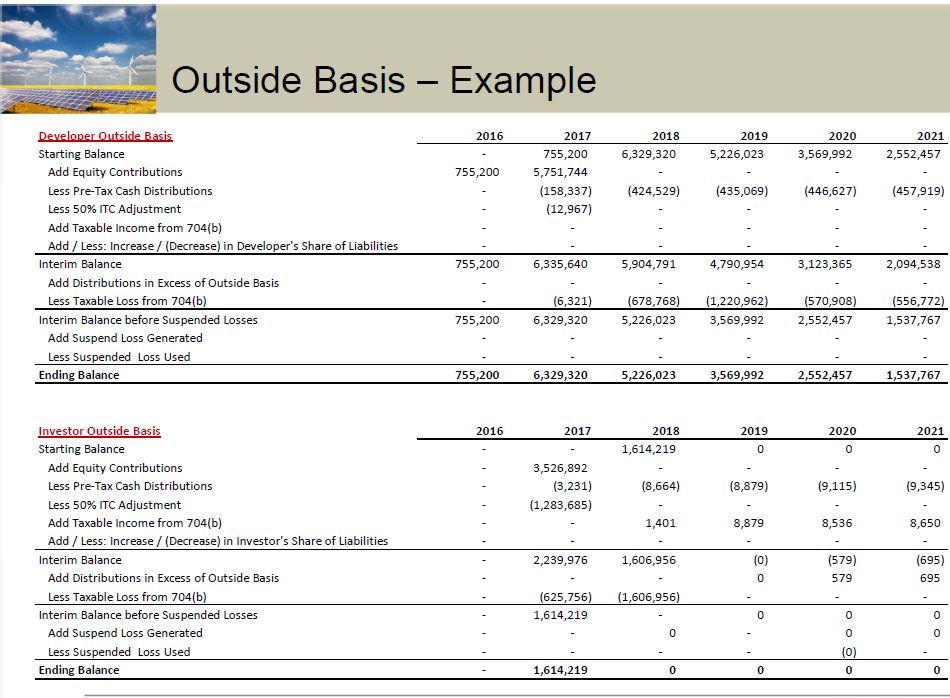

Web If the withdrawals line 10 andor a decrease in partnership liabilities line 9 exceed the partners at-risk basis the partner must report the excess as capital gain on Schedule D. Web This entails defining and calculating both outside cost basis and inside cost basis. The IRS news release.

Generally a partner does not. Web The rules apply to entities which are treated as partnerships for federal income tax purposes including general partnerships limited partnerships publicly traded. Web As the IRC explains it Inside basis refers to a partnerships basis in its assets One way to look at it is if three partners bought an asset for 600000 each.

Dont file it with your tax return unless. The calculated basis determines. Web loss on the sale of a partnership interest where the partnership has IRC 751 assets and assets having unrecaptured IRC Section 1250 gain.

Web Calculation of basis when the entity is formed including the impact of contributed property. A partner is required to determine the. Keep it for your records.

1 Section 705 and this section provide rules for determining the adjusted basis of a partner s interest in a partnership. Explains the use of both inside and outside basis determination. Assume the asset appreciates to 13 million and one of the original five partners wants.

Web The outside basis is 200000 per partner and the inside basis is 1 million. Understanding Outside Cost Basis. Web Worksheet for Tracking the Basis of a Partners Interest in the Partnership Basis is the amount of your investment in property for tax purposes.

Web a General rule. Carryforward Balance Sheet for Tracking the Inside. It also shows how the partnership.

Web The basis of a partnership interest acquired by contribution is the amount of cash plus the adjusted basis of any contributed property. Web This template calculates each partners outside basis in the partnership which equals the partners tax basis capital account plus his share of partnership liabilities. Outside cost basis refers to what percentage of.

Temporal Evolution Of Single Cell Transcriptomes Of Drosophila Olfactory Projection Neurons Biorxiv

Calculating Basis In A Partnership Interest Youtube

En 301 842 3 V1 3 1 Vhf Air Ground Digital Link Vdl Etsi

Inside Basis Vs Outside Basis

Partnership Capital Account What Is It Format Examples

The Marriage Of Sierpinski Triangles And Platonic Polyhedra Wang 2023 Angewandte Chemie International Edition Wiley Online Library

Interest Rates Explained By Raisin

Outside Basis Tax Basis Edward Bodmer Project And Corporate Finance

Partnership Capital Account Revaluations An In Depth Look At Sec 704 C Allocations

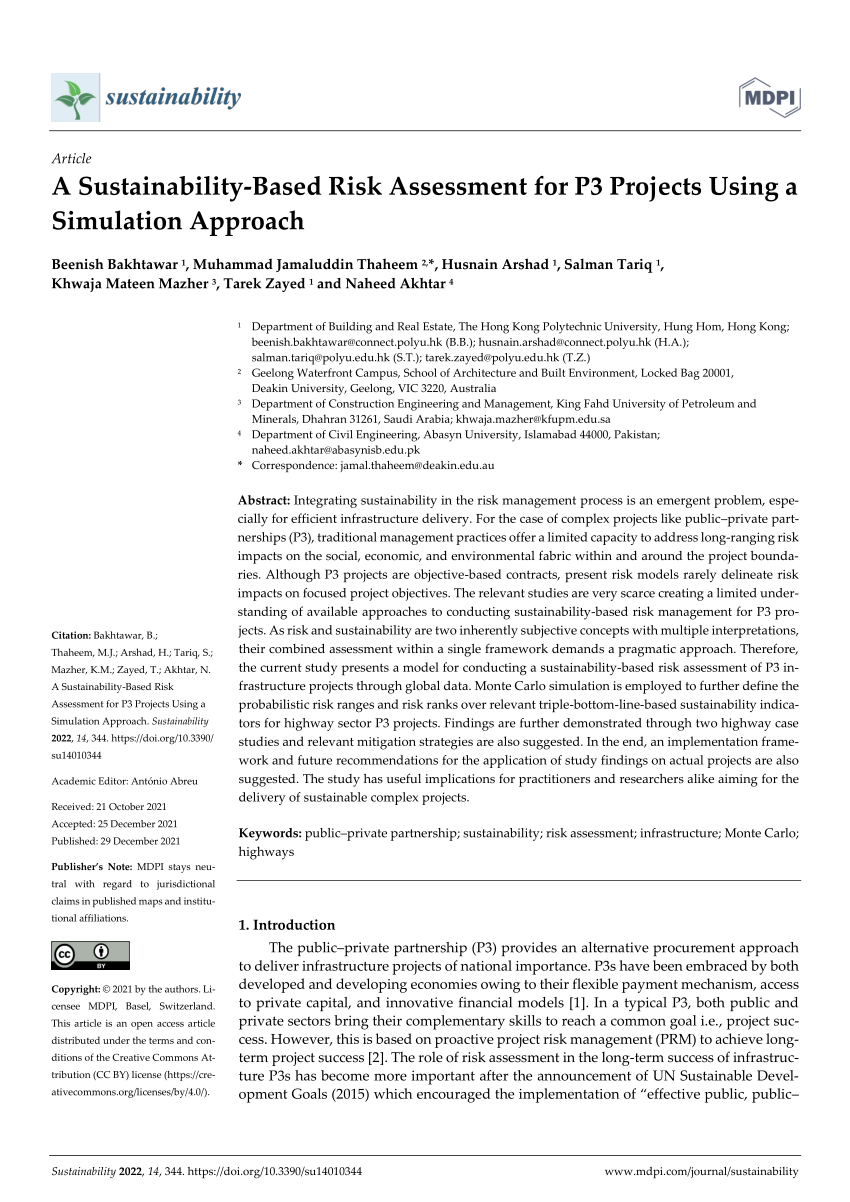

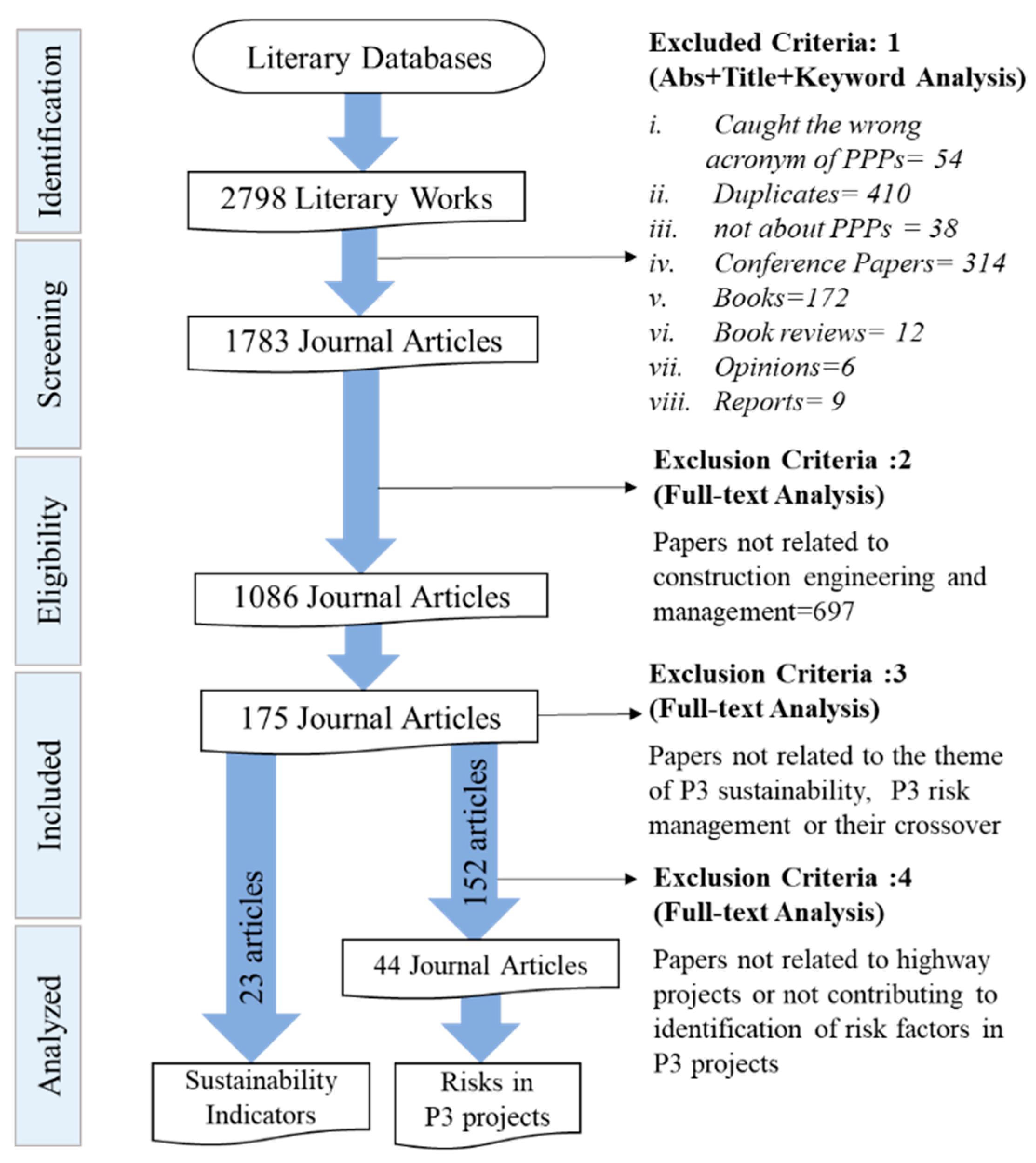

Pdf A Sustainability Based Risk Assessment For P3 Projects Using A Simulation Approach

Sustainability Free Full Text A Sustainability Based Risk Assessment For P3 Projects Using A Simulation Approach

Outside Basis Tax Basis Edward Bodmer Project And Corporate Finance

Outside Basis Tax Basis Edward Bodmer Project And Corporate Finance

How To Calculate Outside Basis Of A Partner Youtube

Calculating Basis In A Partnership Interest Youtube

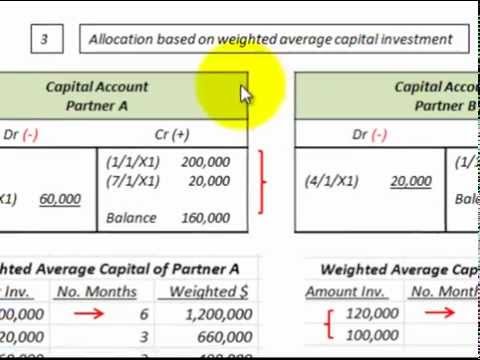

Partnership Accounting For Allocation Of Profit Loss Beg End Of Period Weighted Avg Youtube

Specific Rules Applicable To Corporations Ppt Video Online Download